💡What is BabelFish

If you can’t explain it simply, you don’t understand it well enough!

BabelFish Money is probably the simplest thing in the DeFi Universe.

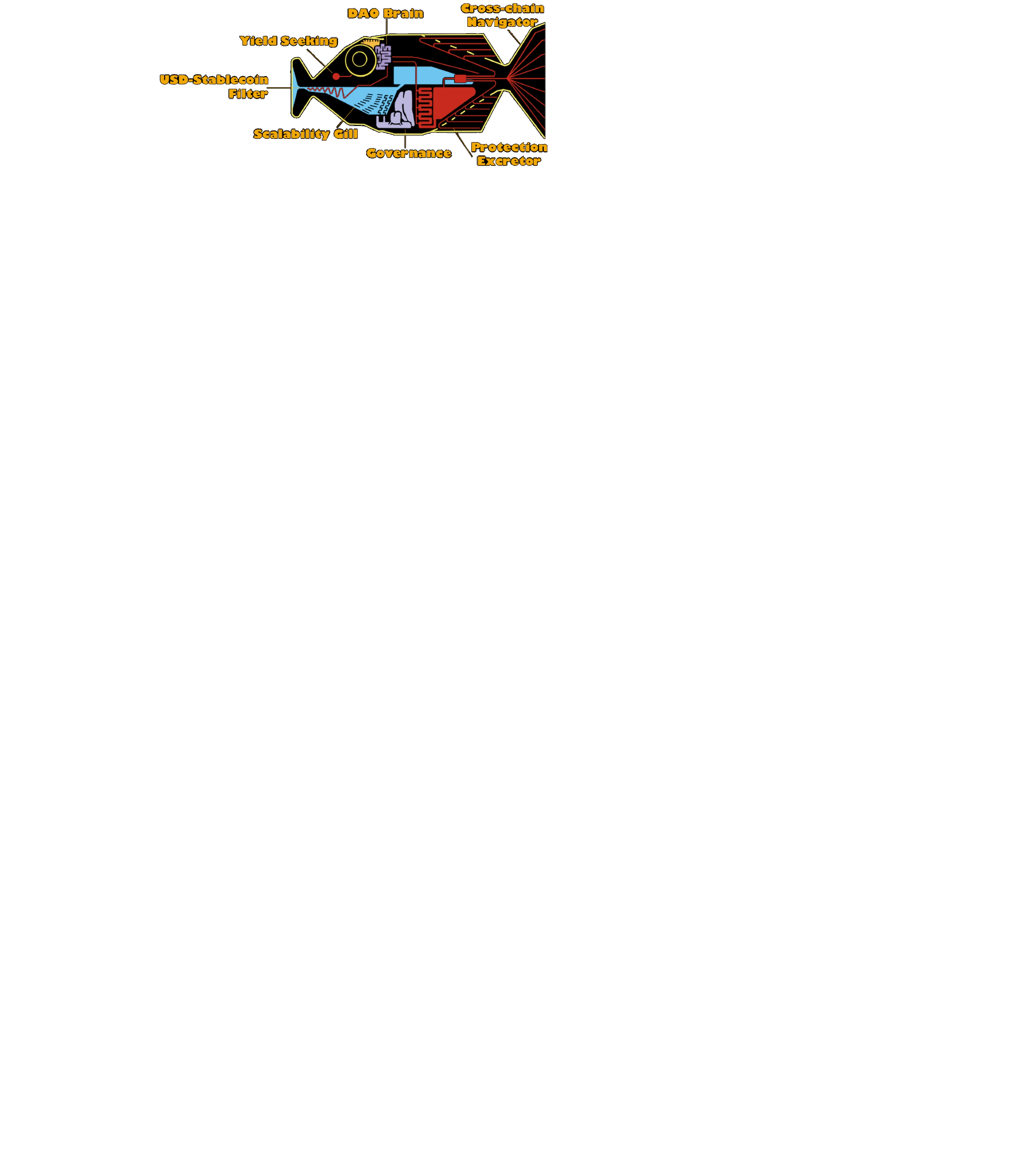

BabelFish's team developed XUSD, a meta-stablecoin aggregating, bridging and distributing stablecoins 1:1 across networks that will also soon lend the collateral in blue chip protocols (e.g. Aave, Compound) to earn yield through a user saving product and lending a percent of the protocol's collateral. The interest from lending protocol collateral will be used to purchase a bitcoin insurance pool and reward FISH stakers on RSK (the protocol’s parent chain).

Soft-launched on mainnet June ‘21 with a focus on enhancing stablecoin flow and hedging risk, XUSD usage has grown organically to become RSK’s largest stablecoin (over $12mn). The DAO governance soft-launched March ‘22 to give FISH holders voice to propose improvements and vote on parameters such as balancing curves and lending of collateral.

BabelFish’s vision is that if a user wants to use her crypto-dollars on another chain, she can stick it on BabelFish and seamlessly get 1:1 exchange on the destination chain in a simple experience that also enables smaller issuers to compete by hedging the allocation of issuers in what is currently a duopoly by centralised issuers.

Think of it as a translation device between stablecoins, a decentralized bank for stablecoins accepting deposits and withdrawals across chains, or a decentralised vision of Centre.io - in fact, you can also visit our site via decentre.io.

What is a stablecoin?

Stablecoins are cryptocurrencies that attempt to peg their market value to some external reference. They may be pegged to a currency like the USD, or to a commodity like gold. USD stablecoins have proven to be the main currency of the crypto space, yet as they bloom and DeFi markets expand, the combined USD-peg liquidity is being fractured amongst issuers, bridges and chains.

In the decentralized economy we ought not to rely on one or two issuers of USD-stablecoins but rather enable a thousand stablecoins to bloom and communicate with each other to bring mass adoption. We propose a simple solution to turn stablecoin liquidity swamps into a liquidity lake: a decentralized aggregator and distributor of stablecoins that can be upgraded to earn yield on the deposits's respective chains.

Why use stablecoins?

There are several reasons cryptocurrency market participants use stablecoins as opposed to traditional ‘risk-off’ assets such as FIAT. Staying in the cryptocurrency market allows them to move faster between trades and exchanges without having to wait days to transfer to fiat money. It’s also true that not all cryptocurrency exchanges support the use of fiat currencies, leaving stablecoin as the only solution.

Last updated